Word on the street > Application Window for M&A Best Practices Award Opens Today; Baby Boomer Business Speak Translator

Word on the Street: Issue 191

Weekly real-time market and industry intelligence from Morrissey Goodale firm leaders.

Application Window for M&A Best Practices Award Opens Today

Introduction

We created the Excellence in Acquisitive Growth Awards series for two reasons. First, to recognize those acquirers that are leading the way in improving how consolidation happens in our industry. Second, to share best practices so that collectively the industry achieves better outcomes from M&A in terms of client satisfaction, employee engagement, and value for investors.

M&A Best Practices Award

Today, the application window opens for the M&A Best Practices Award—the second of the three annual awards in the series.

To be considered for this award, applicants must describe a process, initiative, technique, or strategy used in either their deal-making or in their integration of acquisitions that they consider worthy of recognition as an industry “best practice”—one that could be emulated by other acquirers aiming to achieve better results.

We will present the M&A Best Practices Award to this year’s recipient at the Western States M&A and Business Symposium in June. The venue for this year’s symposium is the luxury five-star Wynn Hotel in Las Vegas where over 200 AE industry executives and investors will be in attendance.

In addition to the award and the accompanying industry recognition, Morrissey Goodale will make a $1,000 donation to an AE industry-related 501(c)(3) organization chosen by the recipient. We will also feature the award recipient and their M&A best practice in an upcoming edition of Word on the Street.

If you would like to be considered for the M&A Best Practices Award, we invite you to complete the simple application form here. The application should take no more than 20 to 30 minutes to complete. The application window closes on May 17. The award recipient will be notified in early June. If you have any questions, please contact our awards department at [email protected].

The Excellence in Acquisitive Growth Awards series

The series is comprised of three annual awards as follows:

1. Most Prolific and Proficient Acquirer Award: Recipients of this award include Bowman Consulting Group (Reston, VA) (ENR #87) and IMEG (Rock Island, IL) (ENR #57).

2024 Most Prolific and Proficient Acquirer Award

Bowman Consulting’s Gary Bowman, CEO (left), and Tim Vaughn, executive vice president of M&A (right),

accept the 2024 Most Prolific and Proficient Acquirer Award from Nick Belitz (center)

2023 Most Prolific and Proficient Acquirer Award

Presented to IMEG in Miami From left to right: Jon Escobar, Nick Belitz, Robin Greenleaf (IMEG), Dan Huntington (IMEG), Bill Zink (IMEG), Mark Goodale, Brendon Cussio

2. Best Post-Transaction Performance Award: The recipients of this award include in the $50 million plus category, TRC Companies (Windsor, CT) (ENR #16); in the $10 million to $50 million category, Salas O’Brien (Santa Ana, CA) (ENR #54); and in the less than $10 million category, Englobe (Montreal, Canada).

The 2023 Best Post-Transaction Performance Awards

From left to right: Daniel Powers, TRC; Nathan Rust, Salas O’Brien; Marc Trudell, Englobe

3. M&A Best Practices Award: The 2023 recipient of this award was Terracon (Olathe, KS) (ENR #20).

M&A Best Practices Award

From left to right: Nick Belitz, Mick Morrissey, Joe Aldern (Terracon), Kristi Tahmasiyan (Terracon),

Mark Goodale, Jon Escobar, Brendon Cussio

The big picture

Industry consolidation continues at a transformational pace of more than 450 transactions a year. Over the past decade, better than 3,500 design and environmental firms have sold or merged here in the United States. Those acquisitions have resulted in step-function increases in profits, revenues, and backlogs for the acquiring firms as they achieve their strategic goals through acquisition.

Industry consolidation will continue to increase over the next decade, fueled by the two trends of industry recapitalization by private equity and boomer and Gen X owners unable to transition ownership internally.

Recognizing that this wave of consolidation will impact all domestic design and environmental firms, we believe that it’s in the best interests of all industry stakeholders—project owners, firm shareholders, managers, and employees—that consolidation takes place in a manner that creates greater value, more stability, enhanced client service, and improved resource allocation.

And that is why we created our Excellence in Acquisitive Growth Awards series. In doing so we wanted to recognize those acquirers that are in the vanguard, improving how consolidation happens in our industry. And we wanted to create a forum to share M&A best practices so that collectively the industry achieves better outcomes in terms of client satisfaction, employee engagement, and value for investors.

We owe a debt of gratitude to the CEOs, corporate development officers, and investors who collaborated with us to help us take this concept and make it a reality.

Engagement

If you wish to be considered for the M&A Best Practices Award, we invite you to complete the simple application form here. The application should take no more than 20 to 30 minutes to complete. The award recipient will be notified in early June. If you have any questions, please contact our awards department at [email protected].

Baby Boomer Business Speak Translator

The language and phrasing in AE firm strategic business plans is often crafted by baby boomer owners, and that can pose challenges for younger generations in the workforce—namely millennials and Gen Zers. Bridging this generational gap requires not only understanding the distinct communication styles of each cohort but also translating strategic initiatives into language that resonates with their values and perspectives. Before we explore several examples of baby boomer-specific prose and how their statements can be effectively translated for millennials and Gen Zers, let’s take a quick look at what tends to make people in these generations tick as well as their communication preferences and tendencies.

Baby Boomers. Born between the mid-1940s and mid-1960s, baby boomers bring a wealth of experience and wisdom to the table. They typically prefer more traditional communication methods, such as phone calls, face-to-face meetings, and written memos. Baby boomers value formal communication channels and may view digital platforms with some skepticism, preferring personal interaction over digital communication tools. In terms of decision-making, baby boomers tend to value hierarchy and authority. They may prefer top-down decision-making processes, where leadership provides direction and employees follow suit. However, they also appreciate thorough analysis and may take time to deliberate before reaching an agreement.

Millennials. Born between the early 1980s and the mid-1990s, millennials are known for their tech-savviness and collaborative nature. They are comfortable navigating various digital platforms and value transparency and inclusivity in communication. Millennials seek feedback and consensus (or at least buy-in) in decision-making processes, thriving in environments where ideas are openly exchanged and everyone’s voice is heard.

Gen Z. Born from the mid-1990s to the early 2010s, Gen Zers are true digital natives who prioritize efficiency and authenticity in communication. They prefer brief and direct interactions, often using digital platforms for communication. Gen Zers value autonomy and individual expression, appreciating opportunities to contribute their ideas independently.

Yet, despite their differences, all three generations share some commonalities in their communication styles. While baby boomers may prefer traditional methods, many also recognize the importance of adapting to technological advancements. Furthermore, all three generations place importance on clear and effective communication. Whether it’s through traditional channels or digital platforms, they seek clarity and understanding in their interactions. Finally, they share a commitment to fostering collaboration and mutual respect in the workplace, recognizing the value of diverse perspectives in decision-making processes.

Now, let’s look at some “baby boomerisms” and how to reframe them for millennials and Gen Zers.

BABY BOOMERISM #1: “We must leverage synergies across our service lines to optimize operational efficiencies and maximize shareholder value.”

Translation for millennials and Gen Zers: “Let’s collaborate across teams to streamline our processes and deliver greater value to our clients and stakeholders.”

Explanation: While baby boomers may value efficiency and optimization, millennials and Gen Zers prioritize collaboration and meaningful impact. By emphasizing teamwork and client-centricity, the translated statement aligns more closely with the values and aspirations of the younger generations.

BABY BOOMERISM #2: “Our strategic imperative is to achieve market leadership through vertical integration and strategic partnerships.”

Translation for millennials and Gen Zers: “Let’s focus on becoming industry leaders by expanding our offerings and forging strategic alliances with key partners.”

Explanation: Millennials and Gen Zers value innovation and adaptability, preferring flexible and agile approaches to growth. By emphasizing expansion and collaboration rather than traditional hierarchical structures, the translated statement resonates more strongly with their preferences and aspirations.

BABY BOOMERISM #3: “We must enhance our brand positioning and market penetration through targeted marketing campaigns and brand repositioning efforts.”

Translation for millennials and Gen Zers: “Let’s strengthen our brand presence and reach by engaging with our audience authentically and creatively across digital platforms.”

Explanation: Millennials and Gen Zers value authenticity and purpose-driven marketing, favoring brands that align with their values and beliefs. The translated statement emphasizes the importance of genuine connections and innovative approaches to marketing, resonating more with the preferences of the younger generations.

BABY BOOMERISM #4: “Our top priority is to achieve revenue growth and profitability through cost optimization and revenue diversification strategies.”

Translation for millennials and Gen Zers: “Let’s focus on driving sustainable growth and financial success by finding new ways to add value and generate revenue.”

Explanation: While baby boomers may prioritize financial metrics and cost-cutting measures, millennials and Gen Zers are more likely to focus on innovation and value creation. The translated statement highlights the importance of innovation and value creation, aligning more closely with their ambitions.

By acknowledging and comprehending the unique communication preferences and values of each generation, AE firms can cultivate inclusive environments where every individual feels respected and appreciated. When such inclusivity is fostered, it not only enhances understanding but also encourages the genuine acceptance and integration of a firm’s strategic initiatives across millennials, Gen Zers, and baby boomers alike.

To contact Mark Goodale, call or text 508.254.3914, or send an email to [email protected].

Market Snapshot: Industry Performance

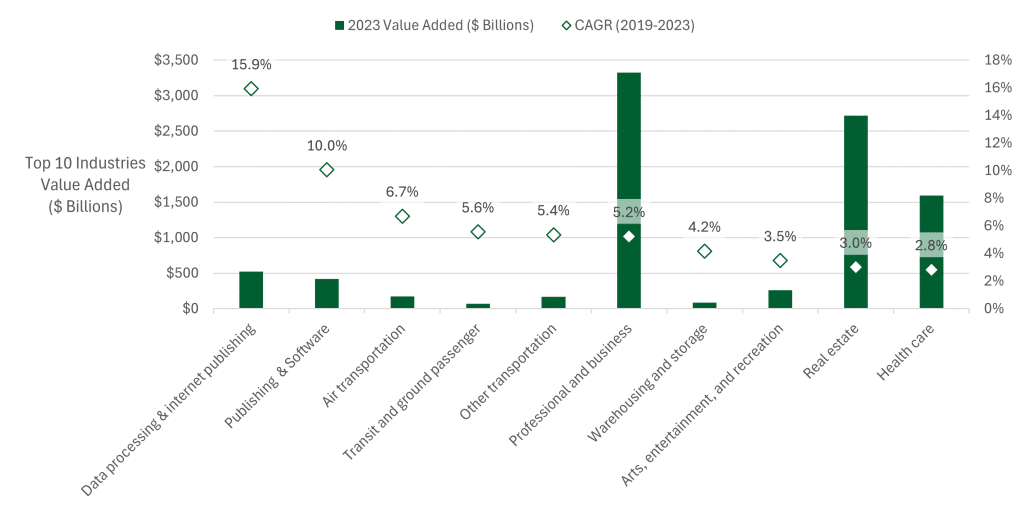

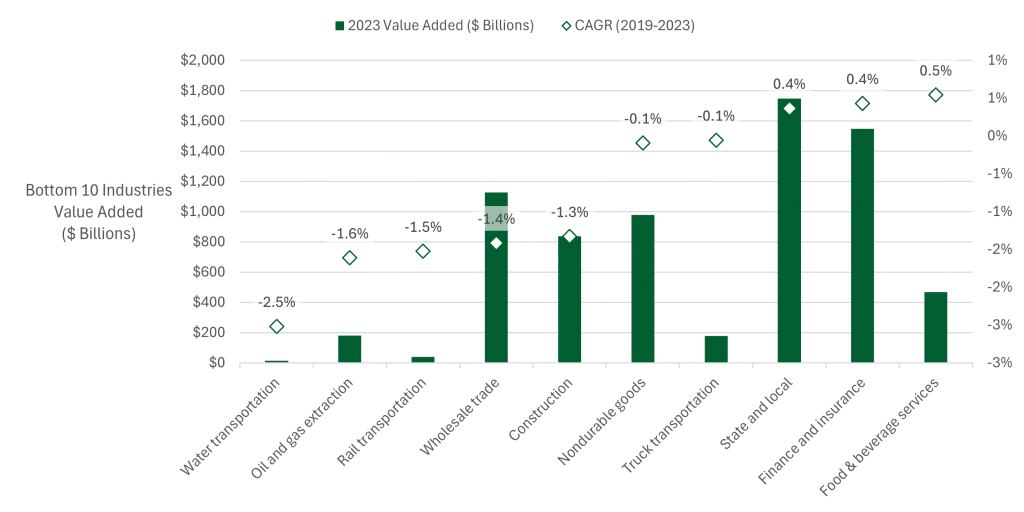

Which industries contributed the most to gross domestic product (GDP) over the last five years?

According to the Bureau of Economic Analysis (BEA), value added is the contribution of an industry or sector to GDP. It is calculated by the gross output of an industry or a sector less its intermediate inputs (resources used to create goods and services). Value added by industry can also be measured as the sum of compensation of employees, taxes on production and imports less subsidies, and gross operating surplus. Below are two charts showing the best- and worst-performing industries based on value added compound annual growth rate (CAGR) over the last five years.

Top 10 Industries:

Bottom 10 Industries:

For the latest insights on U.S. regions and AE markets, check out our 2024 AE Market Intelligence Webinar. Click here to access recording and materials.

To learn more about market intelligence data and research services offered by Morrissey Goodale, schedule an intro call with Rafael Barbosa.

Weekly M&A Round Up

Three deals in the Western U.S.: Last week we announced deals in the West in Arizona, California, and Colorado. We also reported 10 other domestic deals including deals made by two of our “Nine Movers and Shakers to Watch in 2024,” Bowman Consulting Group (ENR #87) and NV5 (ENR #22). You can check all the week’s M&A news here.

October 16-18, 2024 Houston, TX

Texas and the South M&A and Business Symposium

Over two-plus information-packed days, come together to discuss strategy, innovation, and M&A trends while networking with AE industry executives.

Learn More

AI & Innovation

Tap Into the Power of AI for your Firm

We’re partnering with the AI experts at Thrivence to bring AI Education and Business Solutions to the AE and environmental consulting Industry. Introducing a powerful 90-minute, on-demand AI Masterclass designed and delivered by CEOs for CEOs.

Searching for an external Board member?

Our Board of Directors candidate database has over one hundred current and former CEOs, executives, business strategists, and experts from both inside and outside the AE and Environmental Consulting industry who are interested in serving on Boards. Contact Tim Pettepit via email or call him directly at (617) 982-3829 for pricing and access to the database.

Are you interested in serving on an AE firm Board of Directors?

We have numerous clients that are seeking qualified industry executives to serve on their boards. If you’re interested, please upload your resume here.

Subscribe to our Newsletters

Stay up-to-date in real-time.